Stormy Sea

Stormy Sea

An oil painting by Sharon A. Hart

The thought of buying art whilst worldwide economic tsunamis threaten the stability of countries may seem akin to the proverbial tale of Nero playing his lyre and singing while Rome burned. However, the analogy fails because it does not consider the fact that art is not an empty experience of self-indulgence, but a commodity upon which many depend for their “daily bread”. Professional artists and gallery owners are dependent upon the sales of art work to pay their mortgages and feed their children. Likewise, an entire host of peripheral businesses, both large and small, are closely tied to the welfare of the artists---frame shops, corporations that produce moldings, mat board, glass, clay, and various forms of media that are used in the creation of art. Even shipping companies, stationary and book publishers are impacted by the economics of art, for without the patronage of artists, a significant portion of their business would be lost.

Professor Nicholas Negroponte, co-founder of the Media Laboratory at the Massachusetts Institute of Technology, is a visionary pioneer of computer-aided design and is the founder of the One Laptop per Child initiative, which seeks to provide millions of poor children throughout the world with educational opportunities by providing them low-cost laptop computers. Earlier this month he delivered the keynote speech for John Maeda's Inauguration at the Rhode Island School of Design. I was particularly struck by his astute comment, “Hundreds of years from now we will not remember our corporations of today or even prominent politicians. Instead we will be remembered for the great art that our society will leave for future generations. It follows that great art is a great long-term investment. So if you’re going to invest, think about investing in art."

Despite the bearish economic news, the art world has maneuvered through the tough economic times in recent months, and years. One need only look at the highly publicised Sotheby auction where the shameless promoter Damien Hirst flogged his copious wares to recognize that within certain circles money is still flowing freely despite general consumer confidence falling and the economic crisis on Wall Street. In fact, according to Sotheby’s, the eleven days of pre-sale exhibition drew in some 21,000 visitors and the auction house generated a total revenue of £70.5m (over $127m) on 15 September and £40.9m the day after.

Unfortunately, not all art events are as successful as the Sotheby's auction in London. Last weekend I attended Las Vegas Artexpo, at the Mandalay Bay Resort in Las Vegas, Nevada. Whereas last year, Artexpo Las Vegas reported 11,000 attendees, the silence of the hall was a dinning contrast this year. The show’s organizers’ marketing information stated, “The 2008 show has moved to a larger exhibit hall in the Mandalay Bay Convention Center in order to accommodate more exhibitors and buyers. The expansion has enabled the growth of the SOLO Independent Artists Pavilion and the introduction of EXPOSURE, a new section dedicated to burgeoning fine art photographers. Artexpo Las Vegas is quickly establishing itself as the premier fine art fair of the West coast.” With this in mind, I was looking forward to an improvement over last year’s event. Despite this, the show was moved into smaller quarters, was poorly marketed at the local level and experienced very little foot traffic. Many exhibitors failed to sell sufficiently to cover their booth space rentals, and attempted to dismissively take solace in the philosophy that the trade show ultimately was about networking, not sales.

It was obvious that the artists who did well at the show were those who were focusing on art that was unique and well-executed. It also was quite interesting that the alarm may have sounded on abstract and conceptual art, for the few works that sold were figurative and landscape pieces forged from the realistic schools.

It is my belief that the difference between the success of the afore-mentioned spectacle at Sotheby's and Artexpo Las Vegas is that one was successfully promoted and the other was not. In fact, I witnessed little promotion of Artexpo in Las Vegas compared to last year's advertising. In the words of an old adage, "the proof was in the pudding"...and in this case, the pudding flopped by all accounts.

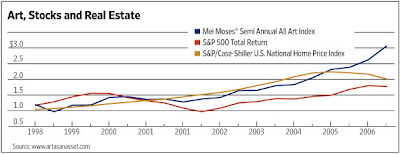

In May, I read an interesting article that asked the question “Should you put your assets in art, stocks, or real estate? “ The article quoted the research of Jianping Mei and Michael Moses’s Semi Annual All Art Index, which compares how approximately 11,000 pieces of art fare when sold and resold at auction. This index was compared to the S & P 500 and the S&P/Case-Shiller U.S. National Home Price Index to track how real property (houses), stocks and art compared as investment property between the period of June and December from 1987 to 2007. It indicated that art offered a better return on one's investment, although one must realize that art cannot be liquidated as quickly as homes or stocks and is also directly impacted by changing societal tastes.

Considering the spiraling subprime mortgage problems, the stock market crashing, and general economic crisis, these discussions become moot issues when one is concerned about how one is going to put gasoline in the vehicles we drive, heat our homes, feed our families and keep a roof over one’s head. However, if one is not in a place to be concerned about Maslow’s Basic Hierarchy of Needs, it appears that art is not only a better investment option for one’s portfolio, but it is actually a responsible choice, for you ultimately employ a domino effect of individuals who are dependent upon a purchase that will delight you and others, not only through a recession or a depression, a bear or a bull market, or simply provide a safe harbor for your assets while the market tsunami crashes all around.

Nathaniel Hawthorne contended, "Religion and art spring from the same root and are close kin. Economics and art are strangers." I emphatically disagree with the final statement. Economics and art are lovers; society should encourage them to fully embrace each other during these turbulant times.

Friday, September 26, 2008

Danceband on the Titanic

Posted by

S. A. Hart

at

9:51 PM

![]()

![]()

Labels: Artexpo, investments, Nathaniel Hawthorne, Nicholas Negroponte, portfolio, religion

Subscribe to:

Post Comments (Atom)

8 comments:

hi Sharon

I like the subtle energy that you have achieved with the monochromatic colours in Stormy Sea...

thanks for taking the time to do the meme :)

you are the featured artist this week at TAD ...

Art is certainly selling well over this way ....though it's a fickle market most of the time and certain artists seem to slip in and out of vogue on a regular basis...

check out the ART NEWS BLOG to read about the latest Aussie success sale at Christies Auction in the UK...

I would have a difficult time explaining this to my mother, who still believes that basic savings accounts have to have a "passbook". But she's mellowing some in the past few years.

Sharon: your graphic is up on my blog and site. Drop in and take a look.

Sharyn

Kim and LuAnn,

Andy Warhol said "Making money is art and working is art and good business is the best art."

Kim, thanks for the feedback on my painting--it's greatly appreciated. The digital image loses much of the nuances, which is a pity. I'm glad to hear the art market is doing well in Australia. Let's hope it keeps up. Thank you also for featuring me at TAD---it's one of my favorite blogs. :-)

Sharyn--Glad to know the graphic is up on your site. Thanks! I'll probably achieve fame from my painting long before I enjoy it from my photographic portraiture. ;-)

Sharon-

Art as a hedge against inflation? Maybe. Art has seemed to appreciate in value [mostly, unfortunately, for deceased artists. Such is the end of life...]; of course, in the Brave New Economic World we're entering, all bets are off.

Thanks for visiting "Chasing The Thunder". Hope to see you again...

-MR

Hi Sharon - Loved this article! How true it is. It is definitely tied to economics! Towns that concentrate on artists and galleries begin to prosper. Art revitalizes our cities. Great job, and yes, this is one of my favorite paintings. Go for it Sharon!

Truthfully I never considered art as a real investment like real estate or stocks, but it's a really great idea, one definitely worth considering as I get older and our economy and government make me look for safer and safer places to invest my money! Great post.

There's a great post in the UK's Telegraph that is entitled "Is Art the New Gold?" Well worth the read. Check it out at

http://www.telegraph.co.uk/arts/main.jhtml?xml=/arts/2008/10/03/basarah.xml

Post a Comment